declare rolex customs | import duty on watches declare rolex customs If you're worried about getting through U.S. customs with foreign-made timepieces or jewelry you brought with you when you left the states, you can register them at a CBP office or to a customs officer in the airport from which you're departing. $500.00

0 · swiss customs on watches

1 · should i declare my watches

2 · import duty on watches

3 · Rolex purchased overseas

4 · Rolex purchased by customs

5 · Rolex duty free watch

6 · Rolex customs tax ad

7 · Rolex customs

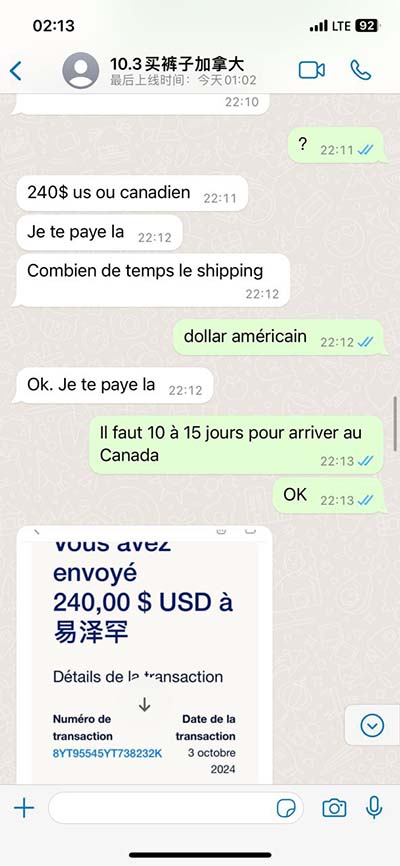

Shop ALLURE HOMME SPORT Eau de Toilette Spray - 5 FL. OZ. and discover more Fragrances at CHANEL.com. Shop now and enjoy complimentary samples.

swiss customs on watches

If you're worried about getting through U.S. customs with foreign-made timepieces or jewelry you brought with you when you left the states, you can register them at a CBP office or to a customs officer in the airport from which you're departing.

should i declare my watches

The first rule is to declare your watches and jewelry. Most advise on declaring each piece before entering the country. You can even do this before you leave home or at the border before setting foot in the country. Next, know what each country requires you to declare. If you're worried about getting through U.S. customs with foreign-made timepieces or jewelry you brought with you when you left the states, you can register them at a CBP office or to a customs officer in the airport from which you're departing.

If you declare your watch at US customs, you may (will?) receive a use tax bill from the state of California. Like the OP, I declared a watch purchase made abroad (a Grand Seiko purchased in Taiwan from an AD). I've heard people say, just wear the watch and have friends ship the box afterwards and no need to declare it at border customs. I can't really find any concrete tax info for customs either for a k watch. Only a customs broker really knows how to do it properly. There were some posts on this forum that used the HST to exploit loopholes. For example declaring the movement to be worth more than the gold case, etc. because they're all calculated at different percentages.

I found lots of threads about what to declare if bought stuff overseas. But what happens if I live in California, bought the Rolex in California, then travel to the UK for example? Do I need to declare the Rolex at the UK Customs - then pay tax?

Customs officer asked me multiple times if I had anything to declare. I declined and was taken to a backroom with my luggage and watch on wrist. Customs officer indicated that I can declare anything I may have forgot to declare or . According to US Customs, an individual can hand carry one Rolex from a trip overseas without permission. Carrying more than one Rolex watch from outside of the country is a trademark violation of Rolex U.S.A. and they can be impounded. Additionally, bringing in a fake Rolex from overseas is also a trademark violation and will be seized.

import duty on watches

Rolex purchased overseas

nike capital bra schuhe

I just bought a Rolex in Switzerland and declared it / paid duty when entering the USA. What are the sales / use tax implications? Will I need to declare it on my tax forms?

If the seller declares the majority of the value in the case and bracelet, you will be paying a higher percentage than if the value is declared mostly in the movement. Quick Example: Rolex valued at ,000. Movement Declared: 000 – .53; Case Declared: 00 – 6.00; Bracelet Declared: 00 – 6.00; Total – 3.23 – 2.15%

The first rule is to declare your watches and jewelry. Most advise on declaring each piece before entering the country. You can even do this before you leave home or at the border before setting foot in the country. Next, know what each country requires you to declare. If you're worried about getting through U.S. customs with foreign-made timepieces or jewelry you brought with you when you left the states, you can register them at a CBP office or to a customs officer in the airport from which you're departing.

If you declare your watch at US customs, you may (will?) receive a use tax bill from the state of California. Like the OP, I declared a watch purchase made abroad (a Grand Seiko purchased in Taiwan from an AD). I've heard people say, just wear the watch and have friends ship the box afterwards and no need to declare it at border customs. I can't really find any concrete tax info for customs either for a k watch.

Only a customs broker really knows how to do it properly. There were some posts on this forum that used the HST to exploit loopholes. For example declaring the movement to be worth more than the gold case, etc. because they're all calculated at different percentages. I found lots of threads about what to declare if bought stuff overseas. But what happens if I live in California, bought the Rolex in California, then travel to the UK for example? Do I need to declare the Rolex at the UK Customs - then pay tax? Customs officer asked me multiple times if I had anything to declare. I declined and was taken to a backroom with my luggage and watch on wrist. Customs officer indicated that I can declare anything I may have forgot to declare or .

According to US Customs, an individual can hand carry one Rolex from a trip overseas without permission. Carrying more than one Rolex watch from outside of the country is a trademark violation of Rolex U.S.A. and they can be impounded. Additionally, bringing in a fake Rolex from overseas is also a trademark violation and will be seized. I just bought a Rolex in Switzerland and declared it / paid duty when entering the USA. What are the sales / use tax implications? Will I need to declare it on my tax forms?

Rolex purchased by customs

Rolex duty free watch

When allure turns sensual, it exudes a natural magnetism. The mystery of a gaze, the elegance of a silhouette, the intonation of a voice all suddenly become intriguing. Like .

declare rolex customs|import duty on watches